Moody’s has avoided prosecution by SEC and others on a technicality, announced some three years after the SEC investigation began!

Sam Jones, wrote in FT’s Alphaville over two years ago about bugs in Moody’s model for rating securitization issues that mistakenly gave top ratings for bonds.

When re-rated after June 2007 using a model in which the bugs had been fixed tens of $billions of CDOS, RMBS, ABS bonds dropped in value by up to 17 risk grades, sometimes from Aaa straight to 'Junk'! Moody's between 2005 and 2007 risk rated about 10,000 Residential Mortgage Backed Securities (RMBS).

http://ftalphaville.ft.com/blog/2008/05/21/13198/ft-alphaville-exclusive-moodys-error-gavetopratings-todebtproducts/

This was based on a fuller account that appeared in a few blogs including my own. Moody’s awarded incorrect triple A ratings to tens of billions of dollars worth of a type of asset covered bonds. The FT wrote, “Internal Moody’s documents seen by the FT show that some senior staff within the credit agency knew early in 2007 that products rated the previous year had received top-notch triple A ratings and that, after a computer coding error was corrected, their ratings should have been up to four notches lower…” In 2007 moody's downgraded about one third of all RMBS. This was the mild form of the story.

It was not just about ratings in 2006; between 2000 and 2007, Moody's rated $4.7 trillion in RMBS!

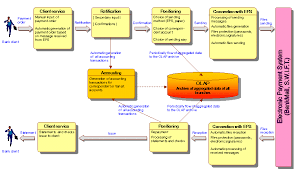

For some model descriptions: Moody’s used its Moody's Individual Loans Analysis (MILAN) model for collateral analysis with a cash flow model such as Moody’s Analyser of Residential Cash Flows (MARCO) or ABSROM. Moody’s analysis was intended to provide RMBS investors with a consistent and transparent system of gradation by which relative credit quality is expressed.

The lack of transparency issue has however been the leading criticism by regulators. The Moody’s objective was laudable - to assign the same ratings to all debt instruments exposed to equivalent credit risks over time, irrespective of the country of origin, the industry sector or the structure of the security. This aim is however subject to differences in law regarding the underlying rights of mortgage borrowers and how the property collateral may be recovered.

Moody's aim was that over the same period of time, portfolios of structured finance securities with the same ratings should sustain similar credit losses. But, the problem remained of not just the history of defaults in the models (or not if they failed to be updated and when the models appeared indifferent to default rates) but also the forecasting of defaults under various economic scenarios?

What happened was that Moody’s modelers noted a speech by Ben Bernanke in January 2007 where he reported that default rates were below 2%, which seemed both counter-intuitive and contrary to other earlier reported figures of 4% and rising. Bernanke had taken his data from Freddy Mac and Fanny Mae, data that was actually post-adjustment after many mortgage deals had been restructured. The modelers decided to put progressively higher default data into their models only to find that every time they cranked the numbers the result was always triple-A or otherwise unchanged from before i.e. the bugs in the model meant they were indifferent to default rates – seriously flawed fundamental errors! And, then they discovered that the models in any case had not been updated for default rates for some years!

When Moody's announced on June 5, 2007 that it was introducing changes to its model, it did not reveal how fundamental this was. It said "

Moody's Expands Loan Characteristics in Subprime RMBS Ratings Analysis - New York, June 05, 2007 -- Moody's Investors Service announced today that its analysis of securities backed

by pools of sub-prime residential mortgages closing after July 1, 2007 will be expanded to include a systematic assessment of certain variables described in the Special Report, "Moody's Revised US Mortgage Loan-by-Loan Data Fields," published April 3, 2007. In addition, Moody's will be modifying the way it incorporates some other factors into its analysis. The refinement of its rating methodology is part of Moody's continuing effort to incorporate the expanding range of loan and borrower characteristics now being captured by many mortgage originators as well as the

performance data that has been accumulated during the past few years in the rapidly growing and evolving sub-prime mortgage market. Moody's expects to continue to refine its methodology in the future as it continues to analyze the increasing amount of performance information that becomes available."

This made the changes seem merely benign, when in fact they heralded the bottom falling out of the interbank credit market.

To those who need to know a little of the technicalities, it may be of interest to note that given limited historical data, Moody’s used three parameters to determine the "lognormal loss distribution": − expected loss (base case losses) of the portfolio − adjusted MILAN Credit Enhancement, and − average life of the portfolio.

Moody’s assessed the expected loss using historical default and recovery data "provided by the Originator" or "based on comparable portfolios and benchmarking". All very well, but range of possible loss data is surely the main feature that the ratings agency model should be bringing to the analysis, not merely using the issuer's own data?

Moody’s used MILAN to determine the MILAN Credit Enhancement (CE), and, in order to derive the ratings of the Notes, Moody’s used a cash flow model, MARCO, which included "key structural elements". MILAN was a risk scoring model, which is not ideal; each loan compared and scored against a country-specific benchmark loan, then, based on certain assumptions (mainly loan to value ratios that are especially relevant in the US, but much less so elsewhere). The credit enhancement necessary to agree with the benchmark loan can be determined, then tagged to a specific rating level (somewhat circular). No mention is made in the Moody's literature I have seen of credit cycle or economic cycle or macro-economics at all!

Overriding accuracy issues for the ratings agencies was also competitive ones of how to win ratings of big issues when the issuers could shop around for who would produce milder or harsher ratings! The question remains unanswered as to whether the ratings models of Fitch and S&P were a lot better than Moody’s or not?

Several internal emails have come to light that show this. For example, a July, 2004 S&P email: "

We are meeting with your group this week to discuss adjusting criteria for rating CDOs of real estate assets this week because of the ongoing threat of losing deals. . . ." [emphasis in original] A March, 2005 S&P email chain shows that agency was slow to roll out ratings model changes because the updated model produced harsher results. Parts of the chain: "

When we first reviewed [model] 6.0 results **a year ago** we saw the sub-prime and Alt-A numbers going up and that was a major point of contention which led to all the model tweaking we've done since. Version 6.0 could've been released months ago and resources assigned elsewhere if we didn't have to massage the sub-prime and Alt-A numbers to preserve market share."

Emails at Moody's include in May, 2007: "

Thanks again for your help (and Mark's) in getting Morgan Stanley up-to-speed with your new methodology. As we discussed last Friday, please find below a list of transactions with which Morgan Stanley is significantly engaged already. . . . We appreciate your willingness to grandfather these transactions [with regards to] Moody's old methodology." And also in August, 2007 Moody's email: "

[E]ach of our current deals is in crisis mode. This is compounded by the fact that we have introduced new criteria for ABS [asset-backed securities] CDOs. Our changes are a response to the fact that we are already putting deals closed in the spring on watch for downgrade. This is unacceptable and we cannot rate the new deals in the same away [sic] we have done before. . . . bankers are under enormous pressure to turn their warehouses into CDO notes."

Such emails show considerable overlap between quality of models and competition for the business to the extent that could be deemed evidence of compromising fiduciary duty to investors etc.

See DailyFinance: http://www.dailyfinance.com/story/investing/more-hot-emails-put-new-heat-on-the-credit-rating-agencies/19452156/?icid=sphere_copyright

Moody's had several points in its modeling where results could be massaged. There was comparison of the specific loan, property and borrower characteristics underlying each loan with those of the benchmark loan. This, if fully true, must have involved massive computing, which I sense may not have been fully deployed.

This then leads to adjustments to necessary credit enhancements of each loan, which are then compared to the minimum credit enhancement determined for a country. Again, we may wonder at the resilience of the benchmark concept?

Once each loan was scored, the portfolio was compared with the country benchmark RMBS in terms of regional, borrower and loan concentrations. This led to additional adjustments on the credit enhancement and ultimately produced the MILAN Credit Enhancement for the portfolio, relating to a specific rating level.

All steps are analysed and discussed by a rating committee. After, and if, further quantitative and qualitative adjustments to the MILAN CE by the rating committee (resulting in the adjusted MILAN CE), then, given a lognormal loss distribution, MARCO is used as a cash flow model for how different features in the transaction impact the final ratings of the Notes (each of the tranches of the securitised bond issued by the SIV).

The model calculates the loss and the average life of the Notes resulting from each portfolio loss scenario of the lognormal curve. The model will then weight each loss and average life on the Notes with the corresponding probability of the loss scenario.

The result is the expected loss and the weighted average life for each tranche in the capital structure. With these two inputs, the ratings can be derived from Moody’s Idealised Expected Loss Table.

That sounds simple actually, simply a way of getting the securities to comply with a standard ratings table. That is, until it is discovered in January 2007 that the models did not actually respond to different default or expected loss rates and that loss rates, presumably for the benchmark loans, had not been updated for several years before 2007!

Former Moody’s Executive Brian Clarkson described the approach as “

you start with a rating and build a deal around a rating”.

While it certainly does exist, rating shopping appears to be a more significant issue in single-issuer debt ratings than in structured ratings. Given that single issuers exist prior to their rating and it is more difficult to change their existing businesses, balance sheets, income statements or structures in anticipation of review, rating shopping is a justified concern.

In structured securities, the SIV corporation (trust) does not exist prior to the rating, the structure to be achieved in order to garner a desired rating is defined by the rating agencies. As a result rating shopping is less a concern than is the pre-rating back and forth negotiations and substitution of underlying collateral which allows issuers to work with the rating agency until they create the structure that achieves the desired rating.

Working backwards and using feedback adjustments to get to a desired ratings is one thing, but operating models that are indifferent to default rates is another. Moody's modelers in January 2007 fixed these latter calamitously major bugs in the models and then found that the bonds or notes when reprocessed dropped by up to 17 risk grades! This they reported upstairs to a shocked board, who must have seen instantly that their company was now at major risk, and perhaps they might have also seen that the whole banking market was also at major risk.

The modelers were told to unfix the fixes and sit on this until it was decided how to handle this; how to tell the world? That thought-leadership process took 6 months, during which time other mind-focusing events occurred such as Bear Stearns securitisation collateral seized and sold at fire-sale prices by Citicorp's back office, triggering Bear's eventual collapse and US Treasury assisted fire-sale to JP Morgan Chase, and then UBS and Citicorp's own structured products exposures were subject to large writedown losses!

Yet, Moody's did not publicly mea culpa or publicly revamp its model until mid-year.

It made an announcement of a new model in June 2007. The news was not considered of fundamental importance to any but perhaps a few.

Then, from June 2007, using a newly fixed model. Moody's regraded securitization issues, mainly RMBS (of which Moody’s had graded more than half of all issues, or $4.7 trillions), that when cranked through the valuation model (a process like Chinese water torture on the interbank credit markets) with day after day, week after week, bank-issued (via SIVs) asset backed bonds and SIV notes (tranches) being severely downgraded that forced banks and eventually other investors to announce major writedown losses! For example on just one perhaps typical day, Moody's Credit Research Announcement 10 JUL 2007 "Moody's downgrades 399 subprime RMBS issued in 2006; 32 additional securities placed on review for possible downgrade". $ billions of RMBS were being downgraded every day.

Confidence in banks’ securities progressively collapsed and the Credit Crunch wreaked havoc on banks’ share values as well as on their ability to finance their funding gaps.

An SEC investigation followed the FT’s exclusive, EU authorities too, not least DG McCreevy when head of Ecofin, were extremely angry at the damage caused and considered suing the ratings agencies in court. Reforming credit ratings agencies became an important part of the G20 agenda. In various parts of the world including Europe various measures were considered and are being introduced to reduce reliance of the US credit ratings agencies. But, this is very difficult to do!

It was obvious that when the ratings were re-run by Moody’s through new models in the second half of 2007, every week more downgrades, that coincided with full onset of the Credit Crunch.

It is reasonable to ask therefore if the securitization issues been properly, accurately, assessed, could the worst of the Credit crunch have been avoided? That is a big question, a big issue!

Similar criticisms of the ratings agencies followed in the wake of the Enron scandal but SEC legal action was not followed through with and was dropped. Enron's rating remained at investment grade until four days before the company collapsed. Similar failures were repeated in the cases of Bear Stearns and Lehman Brothers, and other firms. The ratings agencies failed in the case of Enron to notice that financial trusts linked to Enron made financial commitments largely based on Enron’s share price!

There were regulatory reforms in the US credit rating industry, the Credit Rating Agency Reform Act of 2006, and that put them in the context of the Sarbanes–Oxley Act of 2002. The SEC committed to improve the quality and integrity of the credit rating industry, but instead of focusing on detail resorted to broad reforms such as increasing competition between credit rating agencies including through new market entrants. That the SEC has in the case of Moody’s dropped further investigation on a technicality may have something to do with its own culpability. The SEC has been equipped with enforcement measures, which include the suspension and revocation of NRSRO status, and that may be used, for example, when a credit rating agency does not comply with procedures regarding the prevention of the misuse of material non-public information, conflicts of interest, and other abusive practices. Credit rating agencies are subject to (onsite) examination by SEC and extensive documentation retention and management programmes. It will be a long time before new competition can have a desired effect of improving the quality and integrity of the global US credit rating firms (the big three).

Arguably, the credit rating agencies are more powerful than the regulators in determining the creditworthiness of banks and their bonds. They also have a major responsibility and impact influence on sovereign ratings of governments. Given the influence of credit rating agencies in the capital markets and their regulatory responsibility as private-sector watchdogs, increased oversight of the credit rating industry is most laudable, but also most intimidating for regulators however backed by governments to undertake. Credit rating agencies currently remain prominently in the spotlight of national, federal, and international securities regulators, but appear let off the hook by the SEC, but only on a technicality. They remain subject to possible other agencies including private class actions slowly moving through the courts such as by CALPERS http://online.wsj.com/public/resources/documents/calpers.pdf

Three years on, on Tuesday, 31 August 2010, the SEC released this: “The Securities and Exchange Commission today issued a report cautioning credit rating agencies about deceptive ratings conduct and the importance of sufficient internal controls over the policies, procedures, and methodologies the firms use to determine credit ratings.”

The FT commented that the SEC’s Report of Investigation stems from an Enforcement Division inquiry into whether Moody’s Investors Service, Inc. (MIS) — the credit rating business segment of Moody’s Corporation — violated the registration provisions or the antifraud provisions of the federal securities laws. The Report says that “because of uncertainty regarding a jurisdictional nexus between the United States and the relevant ratings conduct, the Commission declined to pursue a fraud enforcement action in this matter…”

So, Moody’s has escaped prosecution for “fraud” because the relevant American legislation was defective – a shortcoming, the SEC notes has been expressly addressed in the newly-minted Dodd-Frank Wall Street Reform and Consumer Protection Act.

You can read the report at http://www.sec.gov/litigation/investreport/34-62802.htm

On May 20, 2008, the Financial Times published on its Web site an article that disclosed the coding error, citing internal Moody’s documents that showed the error had been discovered by MIS over a year earlier, and alleged that MIS had incorrectly awarded Aaa credit ratings to CPDO notes because of the error.

When Moody’s was contacted by reporters gathering information for the story, the company began an internal investigation into the coding error and the CPDO rating committee conduct. On July 1, 2008, a year and a half after the coding error had been discovered, and over a year after the European rating committee had declined to downgrade the credit ratings, Moody’s issued a press release discussing the investigation results and stating that “some committee members considered factors inappropriate to the rating process when reviewing CPDO ratings following the discovery of the model error.” Thereafter, MIS took personnel action with respect to management of the CPDO group and members of the committee, including termination of the Group Managing Director and two Team Managing Directors…

…Further, we conclude that, in early 2007, members of the European rating committee believed they could violate MIS’s procedures without detection, and in fact the conduct did not come to light until the Financial Times contacted MIS about the error in the CPDO model and an investigation ensued…

Note that today Moody's re-ratings actions based on improving or continued deterioration of subprime securitisations, or in conjunction with distressed or improving house price and rising or falling unemployment, will run each individual pool of mortgage loans through a number of stress scenarios to assess the rating implications of updated loss expectations. The scenarios include 96 different combinations within six loss levels, four timing curves and four prepayment curves.

For much more on all of this, I wrote about it in October 2008

http://bankingeconomics.blogspot.com/2008/10/risk-rating-smoking-gun.html

Also see:

http://newsroom-magazine.com/2010/governance/financial-crisis-governance/moodys-internal-corruption-detailed/

http://www.fcic.gov/reports/pdfs/2010-0602-Credit-Ratings.pdf

.jpg)